Your mortgage, your way — fast, reliable, and expert-guided.

Instantly check your eligibility, compare personalized loan options, and get pre-approved in minutes—with no impact to your credit. Whether you’re buying, refinancing, or investing, we combine cutting-edge technology with expert support to help you close faster, with less hassle and more savings.

1 min | No credit impact

Purchase Loans

Buy with confidence—first home or vacation spot. We offer FHA, VA, Conventional, and Non-QM loans made for self-employed buyers or those with unique income.

Refinance Loans

Lower your payment or cash out equity with ease. Choose from FHA, VA, Conventional, or Non-QM loans—ideal for self-employed or non-traditional borrowers.

Purchase Loans

Buy with confidence—first home or vacation spot. We offer FHA, VA, Conventional, and Non-QM loans made for self-employed buyers or those with unique income.

Refinance Loans

Lower your payment or cash out equity with ease. Choose from FHA, VA, Conventional, or Non-QM loans—ideal for self-employed or non-traditional borrowers.

Home Equity

Use your home’s equity to renovate, pay off debt, or cover large expenses. Choose from flexible HELOCs and home equity loans that fit your financial needs.

DSCR Loans

Finance rental properties with ease—single units or full portfolios. ARMs and 30-year fixed options available, with interest-only or fully amortized payments.

Bridge Loans

Fuel your next flip with up to 90% purchase financing and 100% rehab funding. No appraisal or application fees—just fast, reliable capital for your projects.

Fast, Easy Process

Our streamlined platform and hands-on support make getting approved and closed quicker than ever.

Customized Loan Experience

Every borrower’s situation is different—we tailor every loan to meet your exact needs, goals, and timeline.

Trusted Expertise, Real Results

Backed by years of industry experience, we deliver smart solutions and real results—whether you’re buying, refinancing, or investing.

Low, Competitive Costs

We offer some of the most competitive pricing in the market—without sacrificing speed, flexibility, or service.

What clients say

about working with us

Learn. Plan. Buy Smarter.

Your Mortgage Learning Center—Let’s make financing simple, transparent, and on your terms.

Empower your next move with expert guides, smart tools, and real answers—no fluff. Whether you’re buying your first home, refinancing, or building a rental portfolio, we break it down in plain English.

First-time buyer guides

Learn how to qualify, what to expect, and how to lock in the best deal—step-by-step.

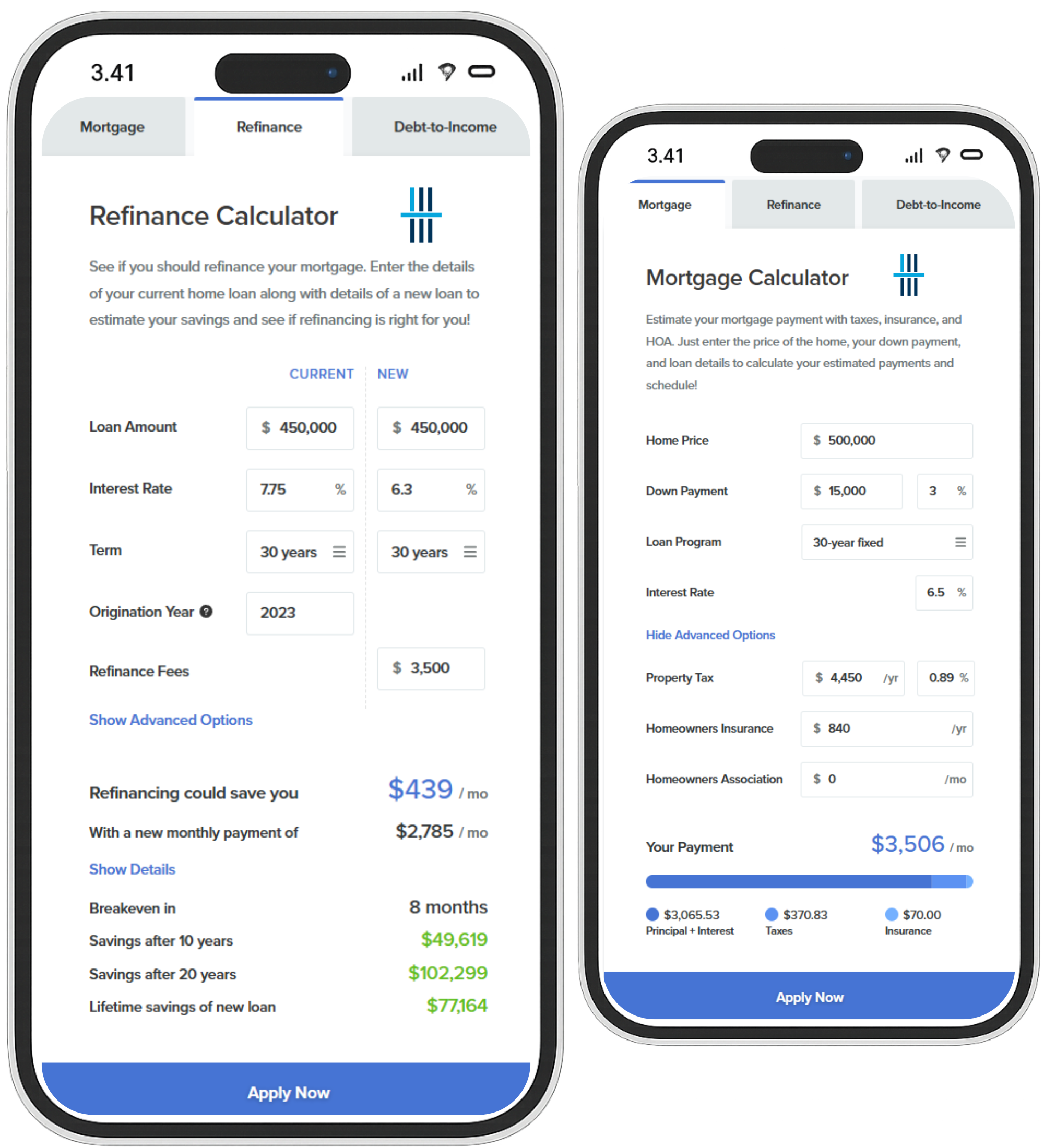

Mortgage calculators

Estimate payments, down payments, affordability, and potential returns on investment properties.

Refinance smarter

Discover when it makes sense, how to lower your rate or pull equity, and what to avoid.

Loan options explained

Compare FHA, VA, Conventional, NonQM, DSCR, and more—see what works for you, not just the average borrower.

Pro tips from loan experts

Get insights straight from experienced mortgage pros—designed to help you avoid costly mistakes.

Let’s make your home goals happen

Answer a few quick questions to see your personalized loan options—no commitment, just real numbers.